Closing the Financial Books on 1 Year of Travel (August 2022 – July 2023)

One year of international travel is finally behind us and it was amazing how quickly the time went by! But with so many new things to see, do, and experience, perhaps I shouldn’t be so surprised.

It’s been a great journey, but international travel isn’t free.

Our stated goal at the start of this crazy adventure was that we would spend no more than $2,500 USD per month on average, or $30,000 USD for our first year of travel.

So how did we do?

I made strong hints in the last couple of budget posts that things were looking promising.

Let’s first take a look at our July 2023 budget report to see how everything worked out. Then we’ll look at the damage we did after 1 year of travel.

ACCOMMODATION: $752.64 USD

Another pricey month of accommodations in Panama. This includes 21 nights in Bocas del Toro province Airbnb ($513.24 USD) and 6 nights in our Panama City Airbnb ($239.40 USD). Remember, we also spent 4 nights for free doing our Panama City Workaway, which was a nice expense mitigation tool.

EATING OUT: $371.75 USD

This expense category has been lower than in recent months in Panama, but that is because we spent the majority of July in jungle isolation!

We made up for that to a certain extent with our Isla Colon getaway and by wrapping up the month in Panama City. But still, we ended up doing better than Panama’s “normal”.

GROCERIES: $555.84 USD

On the flip side, we spent quite a bit more on groceries.

Again, this was to be expected considering our circumstances. The grocery stores in Almirante nearest to our Bocas del Toro province Airbnb weren’t exactly cheap for many normal supplies, and we had no alternatives aside from eating only rice and beans.

No thanks.

We also juiced this expense category by stocking the kitchen of our new Airbnb in Panama City near the end of the month. We’ll be posting about that next!

GENERAL SUPPLIES: $62.67 USD

The majority of this expense category was making small quality-of-life purchases to fill in the kitchen gaps for our last two Airbnbs. The remainder was for various disposable items like detergent, shampoo, and the like.

All and all, nothing really crazy going on here.

TRANSPORTATION: $158.84 USD

An expensive travel month.

The bulk of this category was made up of our transportation from Isla Colon to Panama City ($82 USD with tips) and our emergency water taxi ride to deal with the protesters on Isla Colon ($22 USD). The remainder was from Uber, public bus, and short water taxi rides.

ACTIVITIES: $353.81 USD

An expensive activities month.

We included our private transportation to Isla Colon in this category ($60 USD), our Isla Colon Airbnb stay ($127.81 USD for 4 nights), our island archipelago tour ($66 USD with tip), bioluminescence tour ($50 USD), a coconut bread making workshop at OjoBIO ($30 USD), and the entrance fee to the Panama Viejo archaeological site ($20 USD).

ALCOHOL: $77.46 USD

We celebrated more on Isla Colon and in Panama City, but we were still pretty reasonable. Happy hour cocktails and boxed wine for the win!

UTILITIES/UPKEEP: $10.50 USD

Barely anything to report here.

The LTE data recharge cards purchased in past months carried us through July just fine as we didn’t have a cell signal for more than half the month!

$10 USD went toward recharging our Panama City metro card and $0.50 USD went toward public bathroom fees.

That’s it.

MISCELLANEOUS: $78.10 USD

We purchased a bunch of gifts for relatives back in the USA.

Other than that, nothing really to report.

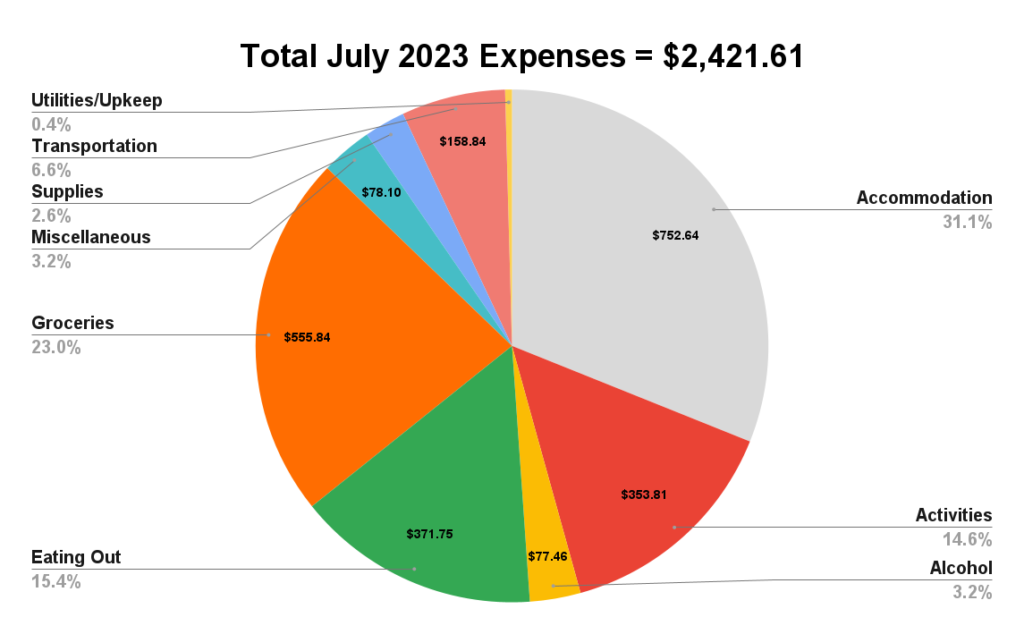

TOTAL EXPENSES FOR JULY 2023 = $2,421.61 USD

Even with an expensive Isla Colon getaway and big transportation expenses (relatively speaking), we still came under our $2,500 USD monthly goal.

Not bad!

As usual, here is a visual breakdown of our monthly spending vices:

And now that we have data for 12 months of slow travel, let’s take a look at that as well.

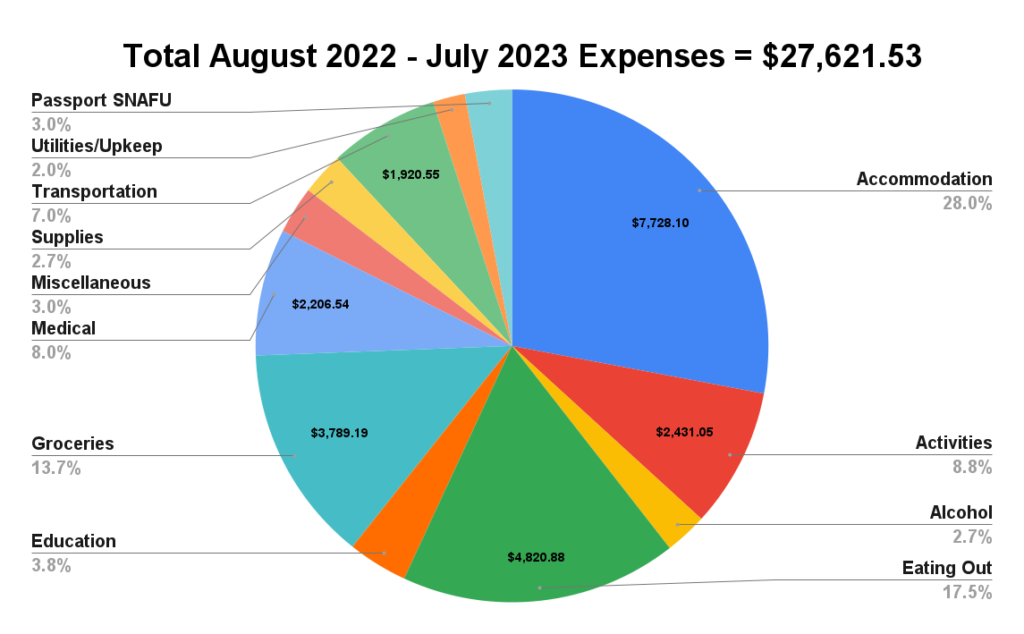

TOTAL EXPENSES FOR YEAR 1 (August 2022 – July 2023) = $27,621.53 USD

So we ended up UNDER budget for the year by about $2,400 USD. Pretty good!

And this is a welcome thing because we need a technology and clothing resupply when we visit the USA in September/October! So we need extra money to burn.

The reason we haven’t made technology purchases sooner is that it is significantly cheaper to buy in the USA than in Latin America.

And with regard to clothes, we are much more svelte than when we started our travels! Clothing that fits is hard to find in Latin America when you are as tall as we are.

So what did each travel expense category look like for the year?

Here is a tabular breakdown of our year 1 budget report:

| Accommodation | $7,728.10 |

| Activities | $2,431.05 |

| Alcohol | $738.85 |

| Eating Out | $4,820.88 |

| Education | $1,043.21 |

| Groceries | $3,789.19 |

| Medical | $2,206.54 |

| Miscellaneous | $826.40 |

| Supplies | $741.13 |

| Transportation | $1,920.55 |

| Utilities/Upkeep | $559.88 |

| Passport SNAFU | $815.75 |

And here is a more visually appealing version of the data:

So this is what a year of travel looks like for Two Travel Turtles.

Honestly, we didn’t work all that hard to stay under our $30,000 USD annual budget.

And we would have done even better were it not for the passport SNAFU and one-time education expenses!

We just rented sensible Airbnbs (with certain cost limits in mind) and went shopping according to our normal frugal instincts.

Sure, the early days of travel were budgetarily nerve-wracking because we didn’t have the data to know the impact of our spending habits yet.

But once we got in a groove we really didn’t worry much, although we always kept an eye on things.

Bottom line, the more you try to live like a local the more affordable things get financially. If you try to replicate a USA lifestyle in Latin America, you will pay dearly for the privilege.

Year 2 Travel Expense Concerns

What worries us now is how badly we will blow our budget when we return to the USA for 2 months.

Transportation is expensive and inconvenient if you don’t own a car! Thankfully we have some workarounds while we are visiting, in the form of generous relatives who could use chauffeurs.

We hear USA food prices have gotten crazy while we’ve been gone. We will absolutely have to keep detailed records of our spending so we don’t get into trouble. It will be very interesting to see firsthand how USA prices compare to Latin America. Hopefully shopping at Aldi is still a bargain!

Thankfully our housing is covered while we stay with family and friends. And our health insurance covers our preventative medical needs, theoretically at no cost.

Also of future concern, Mexico’s tourist lodging costs have significantly increased.

In 2020, the Mexican government started taxing non-border zone Airbnbs at a ~16% rate, and this doesn’t count the local Airbnb taxes that are also applied. And after Airbnb fees, the total cost of a long-term Airbnb stay can be more than 20% over what is listed.

Basically this means that Airbnbs in Mexico are as expensive as in many places in Europe.

But we are going anyway.

If we keep our 28-night long-term stays to around $800, we should be able to make up the cost in other areas. And I have some pressing quality-of-life medical issues that I can get taken care of in Mexico for significantly cheaper than in the USA, even with medical insurance.

And of course, Mexico is just a great place to visit! It is a beautiful country with much to see, especially for those who love food and archaeology!

Has 1 Year of Slow Travel Bankrupted Us?

Thankfully, no.

Our investment portfolio has performed as designed, providing a reasonable rate of inflation-adjusted growth, while minimizing sequence of return risk.

And the high current interest rates gave our interest-producing investments a nice income surge during our travels, which minimized how much we dipped into our portfolio principal.

In addition, continuing to live below our means during our first 5 years of retirement will help our future selves. The economy has been doing wacky things for the last several years, so it would be best to give our investments more time to percolate before liquidating them for income.

Sequence of returns risk is real. Google it.

Interestingly, retirement financial advisors I follow suggest we could be spending double what we currently are and be perfectly fine at 93 years old. This is, of course, as long as we make key moves to protect our 403(b) and tax-deferred IRA accounts against the future tax torpedo that hits unprepared retirees when Social Security kicks in.

So converting those accounts to Roth IRAs while we are in a low tax bracket will be a big part of our financial picture moving forward, potentially saving our future selves hundreds of thousands of dollars.

Retirement financial planning 101, really. Way more lucrative than getting a real job at this point.

But we won’t be changing our spending patterns anytime soon. We are perfectly happy spending at our current rate to mitigate sequence of returns risk, so we will continue to do so for the next several years unless inflation forces our hand.

So this is where things stand in the economic world of Two Travel Turtles!

Hopefully our posts over the last year have demonstrated that if you make sensible lifestyle decisions and adjust to your local environment, it’s possible to slow travel long-term without breaking the bank.

We really have had a lot of fun!

Until next time…

Thanks for reading!

Leave a comment below and subscribe to get email notifications whenever we post!

Follow Two Travel Turtles on Facebook and Twitter!

2 thoughts on “Closing the Financial Books on 1 Year of Travel (August 2022 – July 2023)”

You did really good, Mark and Rhonda!!

Thank you!